On January 1, 2013, the US Congress passed The American Taxpayer Relief Act of 2012 also known as H.R. 8.

On January 1, 2013, the US Congress passed The American Taxpayer Relief Act of 2012 also known as H.R. 8.

As part of the bill, the $1 per gallon Biodiesel Blenders Credit was extended through the end of 2013. The incentive offers those producing commercial grade biodiesel the opportunity to apply for a $1.00 incentive for every registered gallon of biodiesel they produce in 2013. The bill also means that any registered biodiesel that was produced in 2012 also qualifies for the credit. Or in other words, some producers just got one heck of a late Christmas present from the US Federal Government!

So, is this a good thing? If you want my opinion, the answer is a resounding “No!” Why you ask? Well, here’s my take on it…

Originally the $1/gal incentive was put in place to give biodiesel producers some incentive to produce commercial biodiesel in the United States. The theory was that the credit would help make biodiesel a more affordable alternative to using diesel fuel. Unfortunately, it didn’t (and still doesn’t) work out that way. Here’s why.

When the tax incentive is in place, the price of new and used cooking oils is simply higher than it is when the incentive is not in place. Usually by about a $1/gal higher.

How does this happen? Simple economics of supply & demand. The suppliers (new & used oil producers) simply set the price that demand (biodiesel producers) will accept. When the incentive is in place, the price goes up. When the incentive isn’t in place, the price goes down (because biodiesel producers can’t “afford” to pay the extra premium and thereby drive the price down.

So, if the price of the feedstock (new & used oil) goes up, then the value of the incentive to the biodiesel producer just went out the window! It benefited them nothing! The money simply went to the oil suppliers (who, last time I looked, weren’t hurting for money).

How do I know this? Well, for the last few years I’ve been tracking what the price of waste vegetable oil runs. I noticed that whenever the tax credit expires, the price for feedstock drops down by about (big surprise) $1/gal within 6 weeks of the expiration date. And, when the tax incentive gets reinstated, the price of feedstock usually comes back up by $1/gal within 6 weeks of the reinstatement.

Last year when it expired I wrote an article about this very phenomenon. Check it out here: Ding, Dong, The Biodiesel Tax Credit’s Dead!

So, with the tax credit reinstated, guess what? Oil prices have already started to climb! [Oh! Say it isn’t so!] Funny how the economics of supply & demand seem to still work in our modern world.

Here’s where my data comes from.

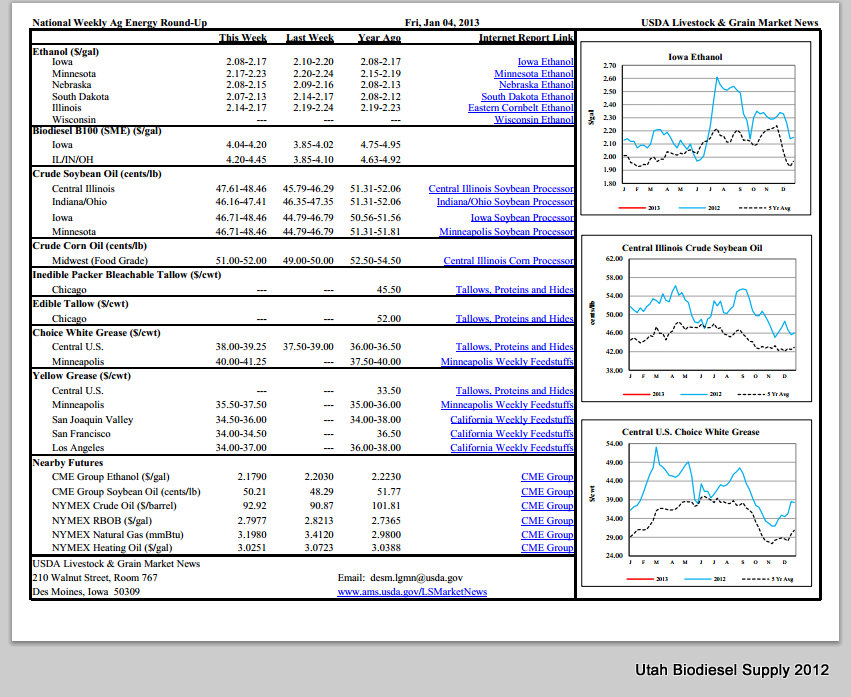

I use the USDA National Weekly Ag Energy Round-Up pricing sheet. It’s updated every Friday by the USDA and includes all sorts of commodities pricing. The one’s I’m particularly interested in are Crude Soybean Oil and Yellow Grease (waste vegetable oil). The prices are in pounds and I use 7.56 lbs of oil in a gallon to come up with dollars per gallon.

Before the credit passed, here’s what the figures were:

Yellow Grease – $2.57 to $2.76/gallon

Soybean Oil – $3.39 to $3.58/gallon

The report posted on Friday, Jan. 4th, 2013, the pricing was:

Yellow Grease – $2.57/gal to $2.84/gal

Soybean Oil – $3.49/gal to $3.58/gal

That’s roughly an $0.08/gal increase for Yellow Grease and a $0.09/gal increase for Soybean Oil. Yep! It’s already taking effect THAT FAST!

So, is the tax credit a good thing? Sure! If you’re in the organic oil business, it’s awesome! You’ll be making about a $1/gal more for your oil in the coming weeks! Life rocks! But if you’re a commercial biodiesel producer buying your oil, it kind of sucks. You’ll get that nice chunk of change from the feds for 2012 that the oil suppliers didn’t get their grubby hands on, but in 2013, I predict that you really won’t get to see any of it because the price of your oil will simply go up by $1/gal and eat any benefit you were getting right out from under you.

It also seems that I’m not the only one that thinks this way. Biodiesel Magazine had a great write up that has similar sentiments in it.

Gratitude, concerns expressed over biodiesel tax credit revival – Biodiesel Magazine.

Now, for biodiesel operations that collect their own oil, the incentive is great! Because they’re able to control the oil cost, the money is just gravy on top of the fuel!

So, while it stinks for the folks that must pay for their oil, for those that collect it and brew it, it’s an awesome deal!

What’s also cool about this incentive is that anyone can realistically apply for and take advantage of it!

If you’d like to learn more about it, stop by our Biodiesel Tax Incentives Page where we discuss the finer points of how to apply for and get the $1.00 per gallon tax incentive.

While you’re there, be sure & check out the Alternative Fuel Refueling Infrastructure Tax Credit as well. It also was given a new lease on life through 2013 and offers up to a 30% credit for commercial biodiesel refueling equipment or up to a $1,000 credit for personal refueling equipment. By the way, because the BioPro’s (BioPro 150, BioPro 190, BioPro 380) come with fuel transfer pumps, they qualify for this credit!

So, while the Biodiesel Tax Incentives & Credits aren’t perfect, if you’re set up properly, they can be a boon to your operation!

My local bio-diesel plant is laughing all the way to the bank and has experienced the best year on record by far at MY EXPENSE, tax incentive or not! Why? They pay me 27 or 28 cents a pound yet the biodiesel prices still up at $3.70/gallon and higher. Then when tax credit comes through they get an additional $1/gal! I have 5 local companies fighting for the same waste oil in the marketplace and regardless of any tax credit I still have to pay 10 cents/pound to buy it. I cannot drop my price to buy it or they simply get a better offer, and they could care less about whether there’s a tax incentive or not. The restaurant makes more than me and all they do is throw it out! I make nothing!

If and when the credit comes through do you think I get anything back? Not a chance.

Collectors like myself have by far the the most costs associated with this entire process and barely hang on when the incentive dies. My local bio plant? Not exactly, as they simply ship it overseas where prices remain high. So, with or without any tax credit the bio plant is just fine but the small local collection company of this feedstock won’t make it without something stable in place.